|

|

Training And

internship News |

|

|||

|

FIRST quarter 2010 |

“WISE Support- it makes the

difference” |

|

|||

Happy 2010!

In the last year, as the economy has shifted, WISE is adapting

to a new market environment by expanding our designation to include new

industry categories, such as Information Media and Communications, and Arts

and Culture. As WISE continues to explore new ways to serve industry partners

and international participants, we also stay abreast of changing visa

regulations. Last year, the Department of State introduced a revised form for

use for all training plans. In this edition of the e-flyer, we will highlight

the expansion of WISE programs, and provide an overview of the new training

plan form. Also, there guidance about how to help trainees and interns with

their 2009 tax returns. In this edition: Revised Form for the DS-7002 Training Plan WISE expands into new industry categories |

|||||

Revised form

for the DS-7002 Training Plan

|

|||||

|

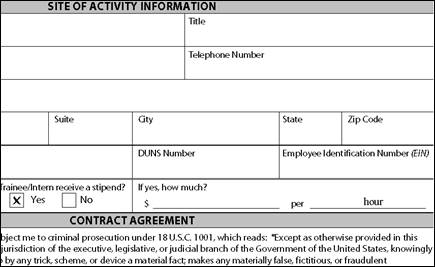

The Department of State has introduced a revision to the DS-7002 training plan form in August, 2009. Among other changes, this form highlights the importance of some key regulatory requirements. The Employee Identification Number and D-U-N-S number are now requested in fields on the first page of the plan.

Detail of the new DS-7002 Training Plan WISE staff are available to assist partners with developing training plans in the new format. Please contact WISE if you need any assistance. |

|||||

WISE expands into new industry categories

|

|||||

|

Interns and trainees are not limited to hospitality service and management programs. The Department of State designates sponsors to host programs other areas and industry categories as well. Last year, WISE expanded the industry categories available to us by expanding our designation into new areas. This allows us to offer a more diverse service to our partners, and expands the options available for qualified international candidates. Students and graduates in WISE programs can now participate in internships and trainings in the following areas: |

|||||

|

·

Information Media and Communications

(New!) – programs in Public Relations, Publishing,

Radio and Television, Advertising and others. ·

Arts and Culture (New!) –

programs in Graphic Design, Illustration, Commercial and Advertising Art,

Theatre Arts Management, and others. ·

Construction and Building Trades (New!)

- programs in Building Management,

Carpentry, Electrical and Power installation, and others. |

|

||||

|

WISE Continues to offer programs in these industry categories: ·

Hospitality and Tourism – programs

in F&B, Rooms, Front Office, Culinary, Spa, Recreation, and others. ·

Management, Business, Commerce and

Finance – programs in Administration, Accounting,

Human Resources, Sales and Marketing and others. ·

Agriculture, Forestry and Fishing –

programs in Dairy Husbandry and Production, Agricultural Business Technology,

and others. The new categories have already been put to use with

participants taking part in Television and Film Production, |

|||||

|

|||||

|

We welcome your comments. Please send all comments to If

you would prefer not to receive the WISE Training and Internship e-update and

would like to be removed from our mailing list, please contact

|

|

||||